What is an Ascending Triangle Pattern in Trading?

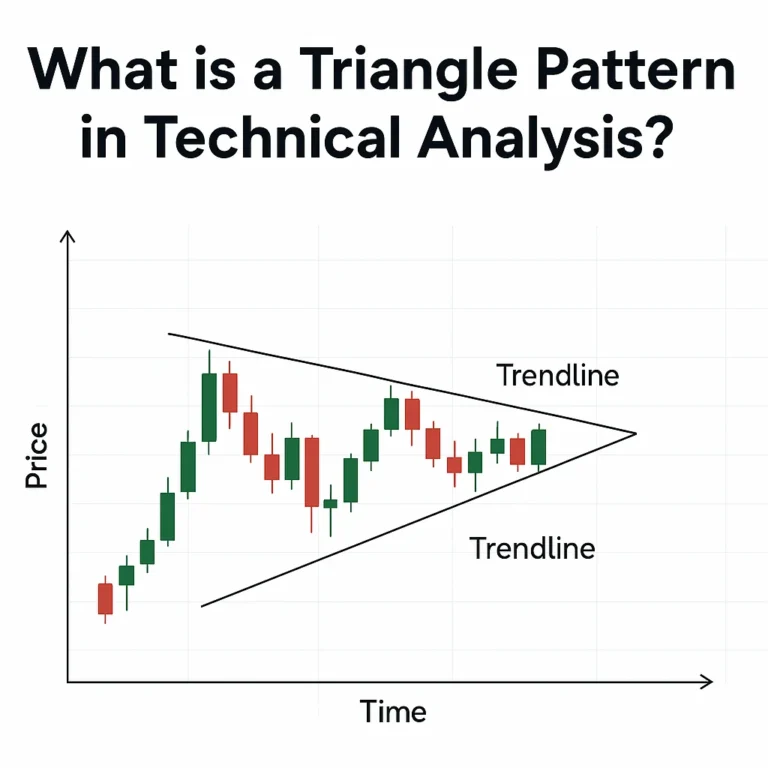

An ascending triangle pattern is a bullish continuation pattern that appears during an uptrend. It forms when the price creates a series of higher lows, but keeps hitting a flat resistance level. This builds pressure beneath the surface, often resulting in a breakout above resistance. Key Features of an Ascending Triangle Why Does It Happen?…