In the world of technical analysis, triangle patterns play a vital role in identifying potential breakouts. Among them, the descending triangle pattern is widely recognized as a bearish continuation pattern that can signal upcoming price breakdowns. This guide will help you decode descending triangle patterns and use them effectively in your trading strategy.

What Is a Descending Triangle Pattern?

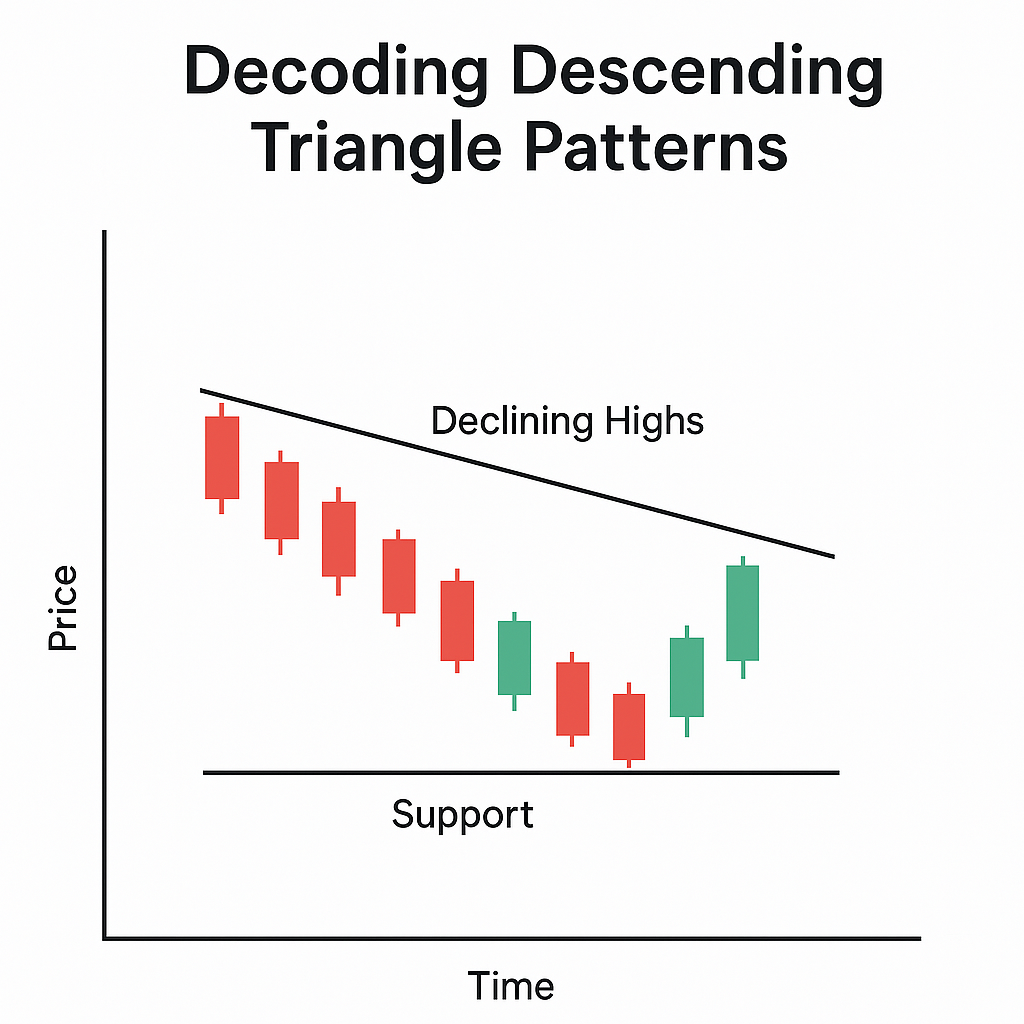

A descending triangle forms when:

- The lower trendline is flat (acting as a support level)

- The upper trendline is sloping downward (showing lower highs)

This pattern suggests sellers are becoming more aggressive, consistently pushing prices lower, while buyers are struggling to hold a specific support level.

📉 It usually ends with a bearish breakout below the support line.

Key Characteristics of Descending Triangles

✅ Flat support line

✅ Series of lower highs

✅ Decreasing volume during pattern formation

✅ Breakout to the downside (in most cases)

Illustration of a descending triangle pattern.

How to Trade Descending Triangle Patterns

1. Identify the Pattern

- Look for a horizontal support line and descending resistance line.

- Ensure there are at least two touches on both lines.

2. Wait for the Breakdown

- Enter short when the price closes below the support level.

- Avoid guessing the breakout direction—wait for confirmation.

3. Confirm with Volume

- Volume should drop during the formation and spike on the breakout.

4. Set a Stop-Loss

- Place the stop-loss just above the last lower high or upper trendline.

5. Set Your Profit Target

- Measure the height of the triangle and subtract it from the breakout level to estimate the target.

Example Trade Setup

- Asset: BTC/USD

- Support Level: $28,000

- Lower Highs: Formed from $30,500 to $28,500

- Breakdown Point: $28,000

- Target: $26,000 (based on $2,000 triangle height)

- Volume: High on breakdown day

📌 Result: Price dropped sharply to $25,900 in 2 days.

Why Descending Triangles Matter

- Bearish Bias: Indicates downward pressure and weak buyer momentum

- High Probability: Breakdowns are frequent and can lead to significant moves

- Clear Setup: Ideal for disciplined traders with predefined risk/reward

Common Mistakes to Avoid

❌ Entering without confirmation

❌ Ignoring volume (fakeouts can happen!)

❌ Placing stop-loss too tight

❌ Trading small patterns on noisy timeframes (like 1-min charts)

FAQs

1. Is the descending triangle always bearish?

Usually, yes. But occasionally, breakouts can go upward—always wait for confirmation.

2. Can I trade descending triangles in crypto?

Absolutely. Crypto markets often show clear descending triangle setups due to volatility.

3. How accurate is the descending triangle pattern?

Historically, descending triangles have a high success rate when confirmed with volume.

4. What timeframes work best for descending triangles?

Daily and 4-hour charts are most reliable, but intraday traders use them too.

5. Can descending triangles be part of a larger pattern?

Yes, they often appear within bigger consolidation structures or trend setups.