Triangle patterns are a trader’s roadmap to predicting breakouts, and real-world examples prove their power in technical analysis. From stocks to forex, these patterns—ascending, descending, and symmetrical—have guided traders to profitable trades by signaling key market shifts. Studying successful trades not only builds confidence but also reveals practical strategies you can apply. In this article, we’ll dive into three case studies of winning trades using triangle patterns, breaking down the setups, entries, and outcomes. Ready to learn from the pros? Let’s explore these success stories on trianglepattern.com.

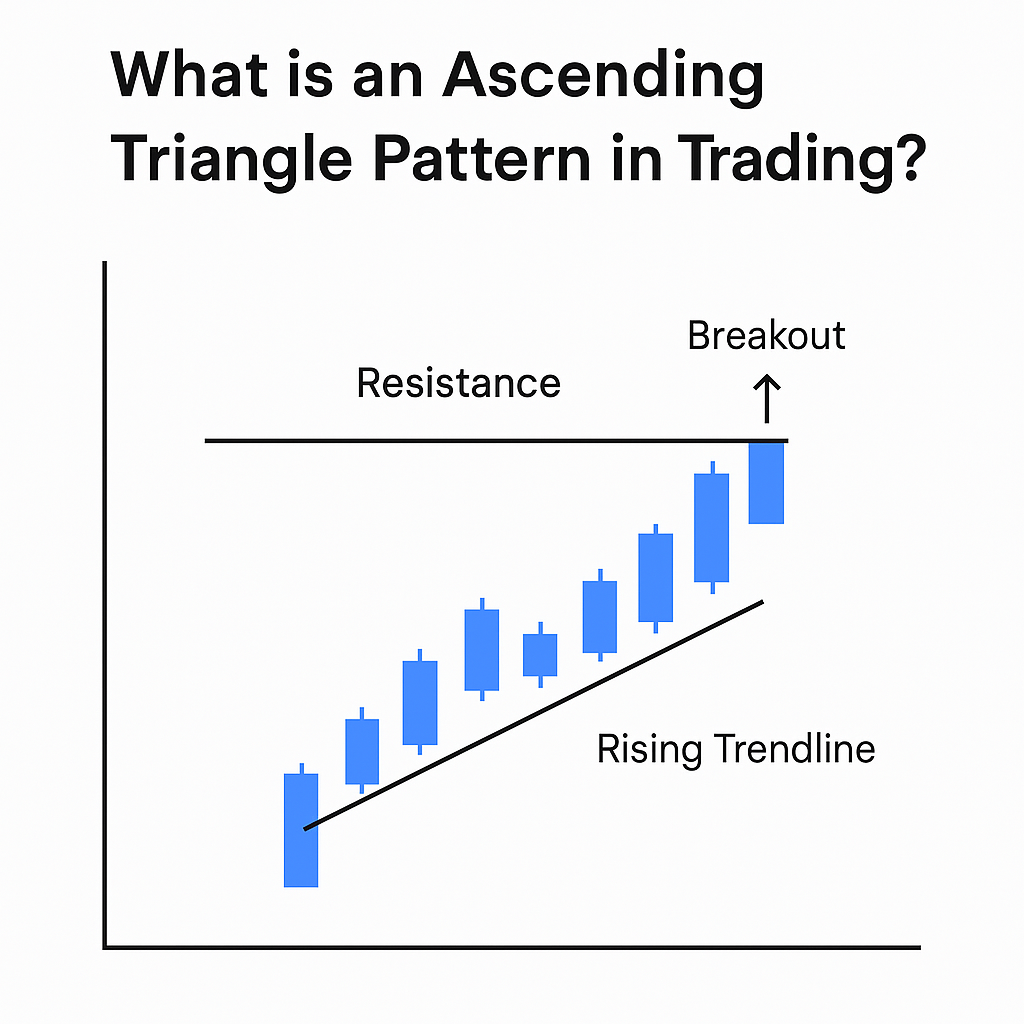

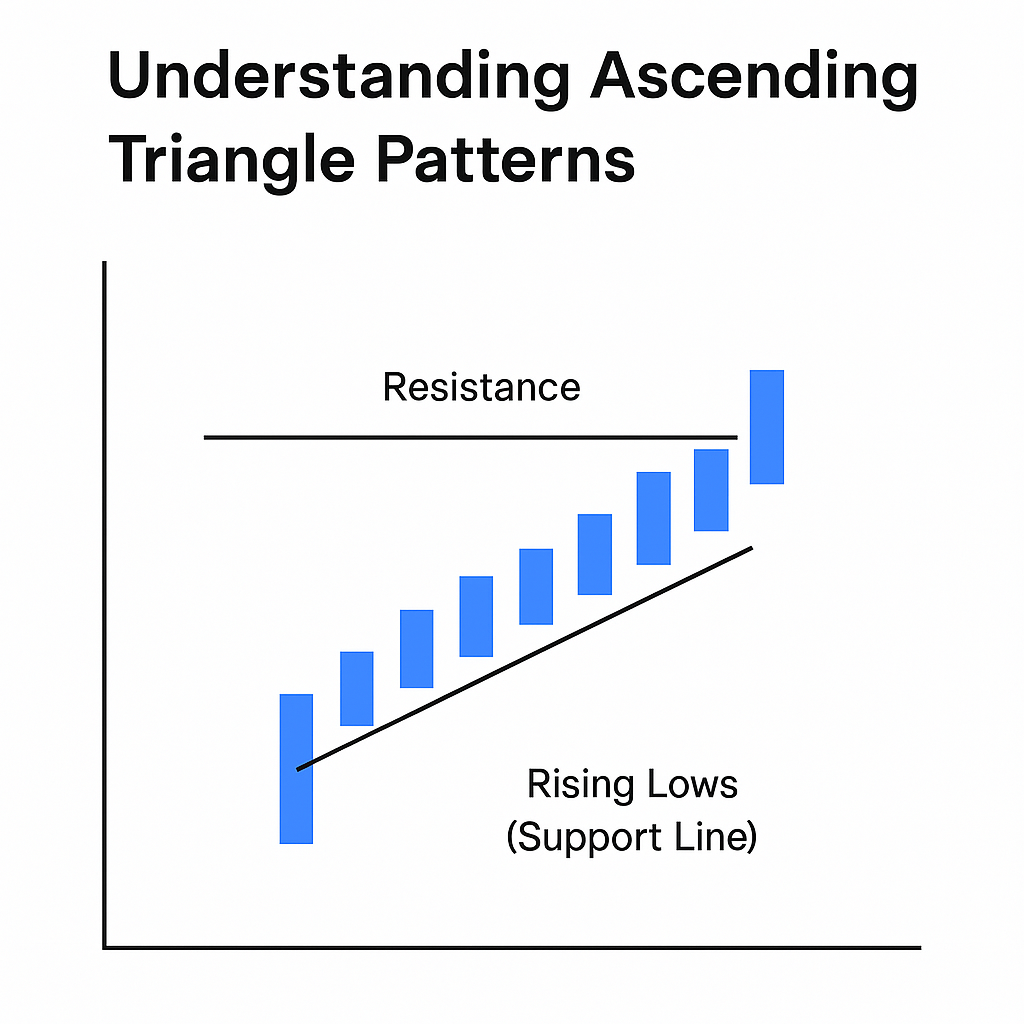

Case Study 1: Ascending Triangle – Apple (AAPL) Stock

- Setup: In mid-2022, Apple’s stock formed an ascending triangle on the daily chart. After a rally from $130, it hit resistance at $150 multiple times, while higher lows formed at $135, $140, and $142, signaling bullish pressure.

- Trade Execution: A trader waited for a breakout above $150 with a volume spike on July 20, 2022. Entry was at $151, with a stop-loss at $145 (below the last low) and a target of $165 (triangle height of $15 added to breakout).

- Outcome: AAPL surged to $166 within two weeks, netting a 10% gain. The disciplined wait for confirmation and risk management paid off.

- Lesson: Patience for volume confirmation in ascending triangles can lock in bullish breakouts.

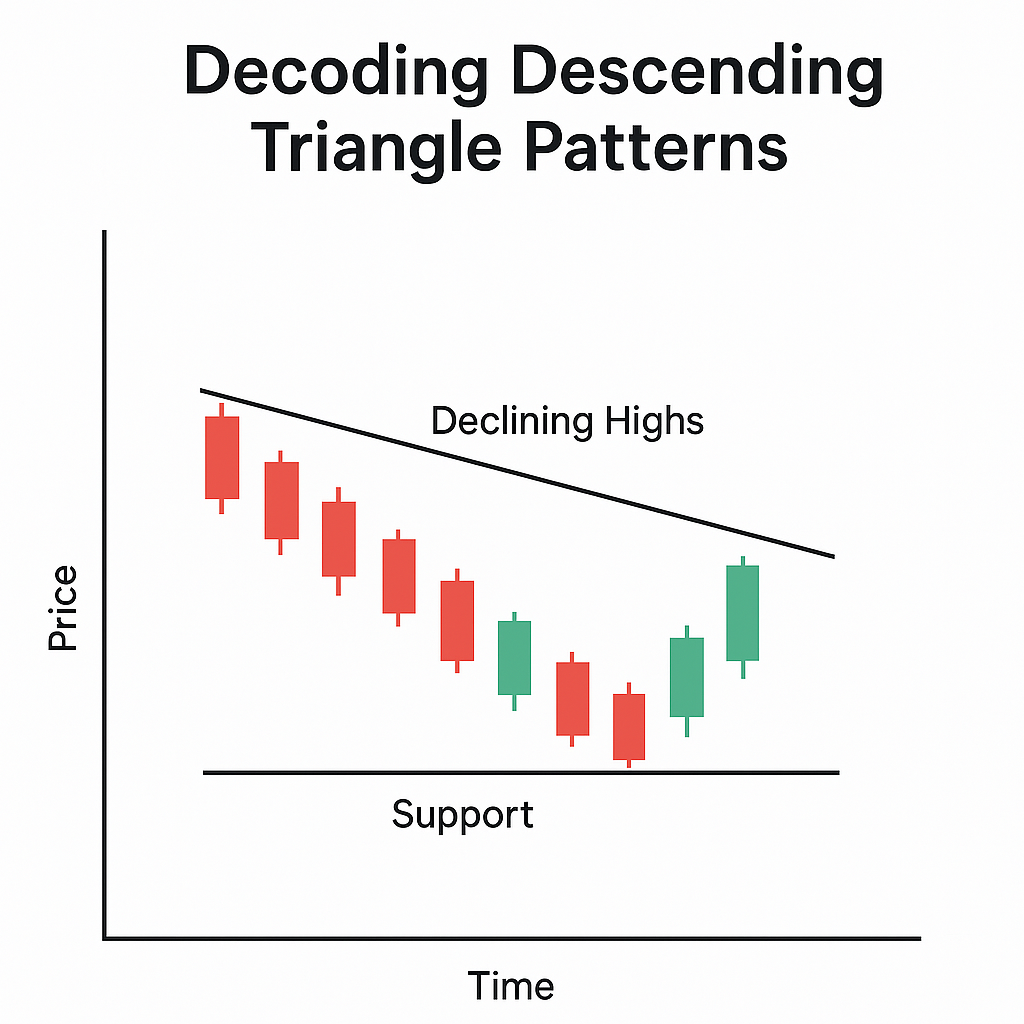

Case Study 2: Descending Triangle – EUR/USD Forex Pair

- Setup: In early 2023, EUR/USD carved out a descending triangle on the 4-hour chart during a downtrend. Support held at 1.05, while lower highs dropped from 1.08 to 1.06, showing seller control.

- Trade Execution: A forex trader shorted at 1.049 after a breakdown below 1.05 on March 10, 2023, confirmed by high volume. Stop-loss was set at 1.055 (above support-turned-resistance), targeting 1.035 (triangle height projected downward).

- Outcome: The pair fell to 1.033 in three days, yielding a 160-pip profit. Quick execution and tight risk control maximized returns.

- Lesson: Descending triangles in downtrends offer reliable bearish signals when paired with swift action.

Case Study 3: Symmetrical Triangle – Bitcoin (BTC/USD)

- Setup: In late 2023, Bitcoin formed a symmetrical triangle on the daily chart after a volatile run to $45,000. Higher lows (from $40,000) and lower highs (from $45,000) converged, reflecting indecision.

- Trade Execution: A crypto trader waited for a breakout, entering long at $46,000 on December 15, 2023, after an upward break with surging volume. Stop-loss was at $44,500, with a target of $49,000 (triangle height added).

- Outcome: BTC hit $49,500 in a week, delivering a 7.5% gain. Flexibility to trade either direction was key.

- Lesson: Symmetrical triangles reward patience and adaptability, as breakouts can go either way.

Key Strategies from These Trades

These case studies highlight universal tactics:

- Confirmation is Crucial: Volume spikes validated each breakout, reducing false signals.

- Risk Management: Tight stop-losses (e.g., below support or above resistance) protected capital.

- Profit Targets: Measuring triangle height provided clear, achievable goals.

- Context Matters: Aligning with the broader trend (uptrend for AAPL, downtrend for EUR/USD) boosted success rates.

Unexpected Insight: Timing the Breakout

A surprising takeaway? Breakouts early in the triangle (before the apex) often had stronger follow-through than those near the end, where momentum faded. This timing nuance can refine your entries.

Conclusion

These case studies showcase the profitability of triangle patterns when traded with discipline and strategy. From Apple’s bullish ascent to Bitcoin’s breakout flexibility, real trades prove that mastering ascending, descending, and symmetrical triangles can unlock consistent wins. Apply these lessons—wait for confirmation, manage risk, and measure targets—to your own charts. Visit trianglepattern.com for more insights and start spotting your next winning trade today!